Welcome to the world of solopreneurship, where you’re not just the boss but also the finance department. While freelancing offers unparalleled freedom, managing your finances can be a maze of challenges. In this guide, we’ll navigate through the intricacies of budgeting and taxes for solopreneurs, ensuring you stay financially savvy and tax-compliant in your solo venture.

Budgeting 101: Your Financial GPS ️

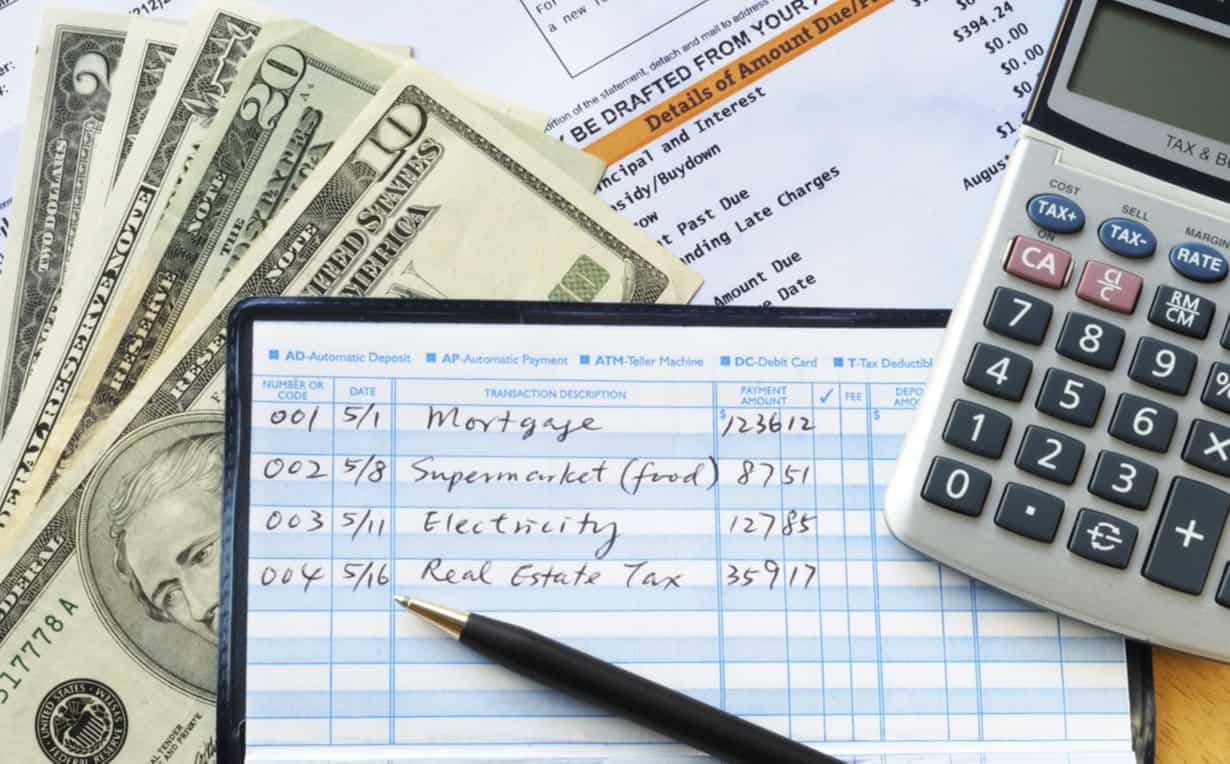

Before you dive into the nitty-gritty of taxes, lay the groundwork with a solid budget. Treat your budget as the financial GPS that guides your solopreneurial journey. Start by outlining your monthly expenses, including business-related costs like software subscriptions, equipment, and marketing. Factor in personal expenses to get a comprehensive view of your financial landscape.

Embrace the 50/30/20 rule: allocate 50% to necessities, 30% to discretionary spending, and 20% to savings or debt repayment. This simple yet effective rule provides a balanced approach to managing your financial resources.

The Tax Conundrum: Navigating the Freelancer’s Tax Landscape

Ah, taxes—the perennial challenge for freelancers. As a solopreneur, you’re responsible for managing your taxes, and ignorance is not bliss when it comes to the IRS. Familiarize yourself with the tax deductions available for freelancers, such as home office expenses, business-related travel, and professional development costs.

Consider setting aside a portion of your income for taxes regularly. This proactive approach ensures you won’t be caught off guard when tax season comes around. Additionally, explore tax-saving strategies like contributing to a solo 401(k) or a Simplified Employee Pension (SEP) IRA to maximize your deductions.

The Emergency Fund: Your Financial Safety Net ⚖️

Freelancing comes with its fair share of uncertainties, making an emergency fund a non-negotiable component of your financial strategy. Aim to build a fund that covers three to six months’ worth of living expenses. This financial safety net provides a buffer during lean periods, offering peace of mind and financial stability.

Invest in Professional Guidance: The ROI of a Good Accountant

While the DIY spirit is admirable, seeking professional advice for your taxes can be a game-changer. A knowledgeable accountant can help you navigate complex tax codes, identify potential deductions, and ensure you remain compliant. Consider it an investment with a high return on peace of mind and optimized tax returns.

Conclusion: Mastering Your Solo Finances

Freelancing is not just a career choice; it’s a financial journey that demands strategic planning and fiscal responsibility. By mastering budgeting and taxes, solopreneurs can pave the way for sustainable success and financial well-being. So, equip yourself with the tools needed to conquer the financial landscape of solopreneurship, and watch your freelancing venture soar to new heights!

Leave a Reply